I remember looking at my bank account, completely confused. What is personal finance if you do not know where your money goes? The numbers did not add up. I was making a decent amount of money, but broke a few days before each payday. My priority shifted to learning about personal finance.

I remember looking at my bank account, completely confused. What is personal finance if you do not know where your money goes? The numbers did not add up. I was making a decent amount of money, but broke a few days before each payday. My priority shifted to learning about personal finance.

Each month, it was the same tiring process. My paycheck would come in, providing reprieve. And then, like water through my fingers, it would disappear. Bills, unexpected expenses…and I was counting the days until the next paycheck. The constant worry of finances settled over me.

I reached the breaking point when my car required repairs, and I had to borrow money again. So, that night, I told myself I had to figure out what personal finance is all about.

I began modestly with budgeting fundamentals. The ideas felt strange at first. Everything started making sense slowly but surely. I wasn’t terrible with money — I never learned how to handle it.

I don’t dread checking my bank account now. I have savings. Money is my servant, not my master.

If you’re making a good income but are leaving nothing behind in terms of savings, there is an escape route. It begins with getting your money working for you.

Table of Contents

ToggleWhat is Personal Finance?

Personal finance is the art of financially intelligent money management, from saving and budgeting to investing and retirement planning. It contributes to overall health, well-being, and quality of life. Gaining control and knowledge of your finances can build a more secure and less stressful future.

Key Components

-

- Budgeting

-

- Saving

-

- Investing

-

- Debt management

-

- Financial goal setting

Core Strategies

-

- You can track monthly income and expenses as well.

-

- Create emergency funds

-

- Diversify investments

-

- Minimize high-interest debt

-

- Budget saved towards future depot expenses

Why is personal finance important in life, and what are its benefits?

Personal finance is an essential skill because it is the basis of financial health for individuals and families. It’s not just about managing money — it’s about establishing a framework for realizing your goals in life, maintaining security, and cultivating lifetime wealth.

This is why personal finance is essential; it maps out your financial journey. It aids in your understanding of your relationship with money, helps you make informed decisions, and helps create plans for economic success in the short and long term. Managing your finances gives you control over your financial future instead of allowing events to decide how you are doing financially.

Here are 10 Benefits of sound personal finance management with an explanation:

-

- Hassle-Free Life: Good money planning takes away money worries. When you have a solid plan for your money, you can pay for everyday things like food and clothes, and still have some saved for surprise expenses like a broken bike/car or a lost jacket.

-

- Insight into Financial Condition: When you keep track of the money you earn and spend, you can see your financial situation more clearly. This helps you understand where your money comes from and where it goes. With this information, you can make better decisions about how to use your money in the future. Knowing about your finances gives you more control over your money choices.

-

- Best Investment Return Plans: Learning about different ways to grow your money helps you choose the best options for your needs. By understanding various investment choices, you can pick ones that match how much risk you’re comfortable with. This knowledge helps you earn better returns on your savings while feeling good about your decisions.

-

- Financial Goal Awareness: Having clear money goals helps you stay motivated to save. When you know what you’re saving for, putting money aside is more straightforward than spending it all. These goals keep you focused and help you make better choices about saving and growing your money.

-

- Emergency Planning: Saving money for emergencies helps you handle unexpected problems without ruining your money plans. When you build an emergency fund, you create a safety net that protects you when surprise expenses arise.

-

- Higher Credit Score: Since you pay your debts on time, your behaviour towards debt has improved, and when you apply for a loan or credit card, it is more accessible with lower fees and rates.

-

- Wealth Creation: Long-term savings and investments help you create wealth and achieve long-term financial goals like buying a home or retiring.

-

- Improved Spending: When you budget, you can pay the bills you care about and cut out those you don’t, thus spending less and saving more.

-

- Financial Freedom: You can choose according to your values and long-term goals without worrying about financial constraints.

-

- Emergency Money: You have sufficient emergency money in your bank account or your pocket so that you do not have to worry about how you will pay your next bill.

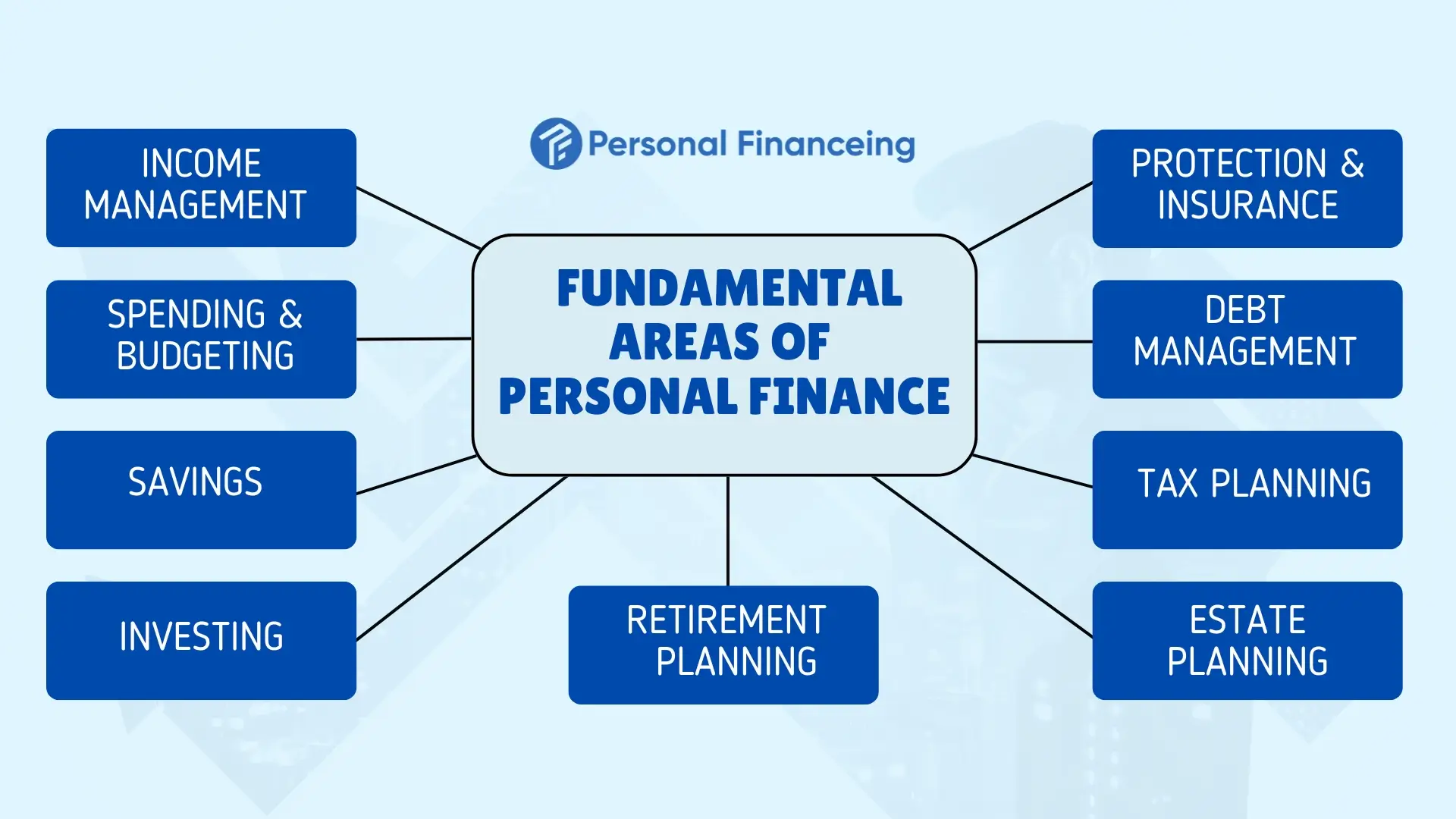

The 9 Fundamental Areas of Personal Finance.

These concepts are the building blocks of financial well-being:

Income Management

Your financial journey starts with how well you manage your income. This includes your pay raise, developing your career path, pursuing passive income streams, and planning your taxes. Consider how income management is the bedrock that supports all other financial decisions.

Spending and Budgeting

Think of this as your financial compass — it guides daily money decisions and shapes your financial habits. Effective budgeting doesn’t stop with following your spending; it’s aligning your spending with your values and goals in life. It’s all about being a master-conscious spender without falling into the lifestyle inflation trap.

Savings

This is your buffer equated to possibilities. The old rules of thumb say to keep up 3-6 months of expenses , but it might be wiser to save even more due to new financial realities. Saving smart isn’t simply about putting aside cash — it’s also about building economic resilience and being ready for opportunity and calamity.

Investing

Think of investing as putting your money to work. This is not about picking stocks versus bonds; you understand and spend time on your asset allocation: how different types of assets can work together or against you to help you meet your goals. The trick is locating investment vehicles appropriate for your risk tolerance, time horizon, and personal values, considering inflation and market cycles.

Protection and Insurance

This is your financial safety net. As much as no one likes to consider the possibility of disaster, having the proper protection through insurance and legal tools in place means that one devastating event doesn’t wipe out decades of financial achievement. This is about preserving your assets and your ability to earn and protect yourself, your family, and your loved ones.

Debt Management

Managing debt is like navigating a complex landscape, whereby some debt (like a mortgage that also builds equity) can be helpful, but the other debt can be destructive. Success on this front looks like knowing the actual cost of borrowing, using it strategically when needed, and maintaining positive credit relationships with lenders.

Tax Planning

Tax planning is using knowledge of the tax code and regulations to reduce your tax liability legally. It involves taking full advantage of deductions, credits and tax-favoured accounts to hang onto more hard-earned cash.

Estate Planning

When you die, estate planning determines what you want to happen to your property. It can involve everything from wills and trusts to all the legal documents to ensure your wishes are met, and your family is cared for.

Retirement Planning

This is how long you would have to keep postponing your retirement. Instead of just saving for retirement, modern retirement planning is about building a design that makes working optional. It’s a matter of knowing how your money needs to work for you in the long run and generating multiple income streams for your retirement years.

With these areas, you can construct a holistic personal finance strategy to help better your financial wellness and life.

Smart Money Tips Delivered to Your Inbox!

Join 20,000+ readers and get expert advice on personal finance, saving, budgeting, and financial planning—free, monthly, and value-packed.

Personal Finance Services

Personal finance services guide people in managing their money and making informed choices to reach their financial objectives.

How Personal Finance Services Work?

Professional financial advisors and firms offer specialized guidance for individuals to help manage money and reach different financial goals. These services usually include:

-

- Client needs gathering– Understanding the financial needs and objectives of your clients

-

- Personalised Investment Plan – Creating customized strategies based on personal needs

-

- Ongoing review and modifications — Tuning plans as markets or conditions change

-

- Fee structure options – Charging through asset-based percentages, fixed fees, or hourly rates

How do Finance Professionals Make Money?

Financial professionals make money in several different ways:

-

- Fee-only services – They charge directly for their time or expertise, either hourly or as a flat rate for specific services

-

- Commission-based products – They earn money when they sell financial products like insurance policies or specific investments

-

- Assets under management (AUM) fees – They charge a percentage (typically 0.5-2% annually) of the total money they manage for you

-

- Retainer fees – They collect regular payments for ongoing financial advice and services throughout the year, like a subscription

Key Personal Finance Services:

Wealth Management

-

- Full-service integration of investment management, financial planning, and other services

-

- Usually demands high-net-worth clients ($250k+ in investible assets)

-

- Revenue: Typically 1-2% of assets under management per year

Retirement Planning

-

- Helps clients with investment strategies, pension analysis, and Social Security optimization to prepare for retirement

-

- Develops savings and distribution plans over the long term

-

- Revenue: Fixed charge of arrangement ($1,000-5,000) or wrapped into property management charges

Estate Planning

-

- Assists with wealth transfer strategies, trust creation, and tax-efficient inheritance planning

-

- Works alongside legal professionals for document preparation

-

- Revenue: Charge customers on an hourly basis ($150-400) or through flat fee packages ($2,000-5,000)

Insurance Planning

-

- Examines client insurance needs in the areas of life, disability, long-term care, and property

-

- Advises correct levels and products of coverage

-

- Revenue: Commission from insurance companies (usually 30% to 100% of the first year’s premium)

Loan and Debt Management

-

- Formulates debt reduction efforts

-

- Helps with loan consolidation and loan refinancing

-

- Revenue: Hourly consulting fees or flat rate packages

Budgeting and Cash Flow

-

- Creates personalized budgets

-

- Creating a spending and savings plan & strategies

-

- Revenue: Usually charges per hour ($100-300) for a month retainer

Tax Planning

-

- Determines opportunities for tax savings

-

- Coordinates with CPAs for implementation

-

- Revenue: Hourly rates or project-based fees ($500-5,000+)

Risk Management

-

- Assesses financial Risks in investments and insurance.

-

- Creates protection strategies

-

- Revenue: Often included in comprehensive planning charges

Credit Card Consulting

-

- Provides tips & plans for building credit

-

- Assists in planning a rewards system

-

- Revenue: Usually consulting fees, billed hourly

Home and Mortgage Planning

-

- Breaks down affordability and financing options

-

- Helps with refinancing choices

-

- Revenue: Flat fee consultancy or mortgage broker commissions

Personal Finance Strategies For Beginners

Whatever your age, financial planning should have been done in the early stages. The earlier you start, the more time your money has to grow.

These tried and true money tactics ensure you make the most out of what you have now and build a more stable future for you and anyone counting on you

-

- Know Where Your Money’s Coming From: Consider this a clear picture of your financial life. It’s akin to a log of what’s going into your wallet — your paycheck, freelance work, perhaps some rent or dividends. When you know what’s coming in, you can better plan where it should go.

-

- Plan Your Spending: Instead of a strict budget that feels like a budget prison, develop a flexible spending plan. Take a month to observe where your money flows to without your intervention — you might be surprised at what you find. And then steer those rivers gently toward what matters to you most.

-

- Pay Yourself Like Your Most Important Bill: Before the bills come in, pay future-you a little something. A little if you can, it is an easy way to start planting seeds to grow over time. And there’s something powerful about paying yourself first before anyone else.

-

- Get Smart About Your Debt: Think of high-interest debt as a leak in your financial boat – plug the biggest holes first. You could decide to pay off small debts quickly for some short-term wins, or you could target high-interest debts first, but the important thing is having a plan you’ll follow.

-

- Borrow Like a Pro: Act like a loaner when you have to borrow. Can you easily afford the monthly payments even if life throws you a curveball? A good rule of thumb is that if your monthly debt payments are taking up more than a third of your income, it may be time to pump the brakes.

-

- Maintain a Good Credit Score: Your credit score is like your financial reputation - you want to keep it healthy. Regular check-ups, timely bill-paying, and keeping your credit card balances in check can pave brighter paths for better rates and opportunities later on.

-

- Build Your Financial Safety Net: Life has a way of throwing unexpected expenses at us. Having a cushion of 3-6 months of living expenses might seem daunting, but start with a smaller goal – maybe $1,000. It’s like having an umbrella before it rains.

-

- Guard Your Money-Making Machine: You’re your own most valuable asset. One of the smartest investments you can make is to take care of your health, develop your skills, and protect your earning ability (through insurance, where necessary)..

-

- Don’t Leave Free Money on the Table: If your employer offers to match your retirement contributions, that’s free money waiting for you. Think of it as getting a bonus just for saving for your future – pretty sweet deal, right?

-

- Play the Tax Game Wisely: There are ways to keep more of your hard-earned money, such as tax-friendly accounts and deductions that benefit you and the IRS. These tools can make sure your money is working harder for you, whether in retirement accounts, health savings, education funds, etc.

-

- Plan the Long Game: Do you want to be in this situation in the future? So whether it is a comfortable retirement, a house of your dreams, or a business that you want to start, the earlier and the more consistent you are, will be of the edge that you give yourself right at the start of a marathon.

-

- Give Yourself Some Grace: Financial planning isn’t about living on rice and beans for life. Allow space in your plan for joy — whether that’s a hobby, travel, or just an occasional nice dinner out. It’s about striking the right balance of preparing for tomorrow and living in today.

-

- Mix Up Your Money Sources: Treat your earnings like a garden — the more variety you grow, the less danger of loss. Perhaps start a side hustle you love, pour some money into dividend-paying stocks or monetize a passion project. If one source dries up, you’ve got others to fall back on.

-

- Get Insurance Wise: No one wants to think about insurance, but it’s essential to a financial force field around your life. Health insurance, life insurance, property insurance – they’re all pieces of the puzzle that keep your financial house standing when storms hit. Just make sure you’re not buying coverage you don’t need.

-

- Work the Tax Angles: Tax planning is like a puzzle; if you put the right pieces where they fit, it can cut your tax bill. Be mindful of the deductions for which you qualify, time your investments wisely, and consider speaking with a tax professional as needed. It’s a bit like having a map to keep more of what you earn.

-

- Save with Purpose: You will work towards different goals at different points and use different strategies to save for them, like using the right tool for the job. While your emergency fund should be kept safely and within reach, allow your long-term savings to do some serious work with investment. Middle ground for investments that result in short-term goals.

What Skills are required to manage finance?

Money management is a skill you probably already practice in your everyday life. The same principles that lead to career and business success can also lead to success with personal money management. Aspects include goal prioritization, costs versus benefits, and expense control.

Financial Prioritization: When deciding whether or not to save money, prioritizing financial matters comes first, which may include establishing an emergency fund, paying off high-interest debt, etc. Prioritizing with financial issues does not include less critical goals like vacations. This includes short-term and long-term objectives, being adaptable (prioritizing based on partial life circumstances in the moment).

Cost-Benefit Analysis: Making wise financial decisions means considering all the available information’s pros and cons. It means much more than just price comparison, but rather includes long-term implications, indirect costs, opportunity costs, possible benefits, and a trade-off between quality and value. By considering these elements, you will be able to make the right financial decisions.

Spending Control: Controlling and Managing of Spending Habits. This includes knowing the difference between needs vs. wants, learning to delay gratification, tracking your budget, managing your emotional spending triggers, and consciously deciding when to buy things.

Financial Research: In today’s financial world, which is both complex and ever-changing, the ability to research and understand relevant financial information is a critical need. This includes understanding different financial products and services, conducting due diligence on options, cross-checking information, keeping abreast of market trends, and accurately vetting investment opportunities.

Strategic Planning: This includes establishing achievable financial objectives and defining the steps required to achieve them, including forecasting potential future needs and problems, adjusting plans as necessary, and appreciating the time value of money.

Risk Management: If your goal is to protect and grow your wealth in the long term, you must manage financial risks. This means checking out different kinds of risks, knowing your insurance requirements, spreading your investments out, developing contingency strategies, and balancing potential risks and benefits for more informed financial decisions.

Financial Communication: Most of the time , though, effective financial communication is a critical but overused soft skill. That means negotiating the financial terms, talking about money openly with family, clearly communicating with financial pros, having a grip on key financial terminology, getting answers to the right questions to inform decisions, and more

Personal Finance Education: Ways to Learn and Grow

So allow me to clarify fully how I think we should learn personal finance:

1. Online Financial Blogs

Nerdwallet has detailed articles about credit cards, investing and banking. It focuses on giving readers the tools and guidance needed to make smart financial decisions and build their finances.

The Balance helps readers make sense of complex financial issues. Written with clear, simple explanations, it walks readers through everything from budgeting to planning for retirement.

Mr. Money Mustache is all about financial independence and living with less, getting you to follow a minimalist lifestyle to financial freedom. The blog focuses on how to save money and still live well.

Get Rich Slowly provides personal stories and practical advice on building wealth. This blog centres around long-term planning with advice on lessening debt, saving, and making wise investments.

I like Investopedia, an excellent source for teaching various financial terms and their definitions. With in-depth articles and tutorials, it educates beginners and experienced investors alike about financial markets and strategies.

2. Best Personal Finance Books You Must Read:

The Psychology of Money by Morgan Housel

Housel’s “Psychology of Money” shows how feelings affect financial choices, summarizes simple wealth-building maxims that emphasize consistency, and applies true stories to illustrate how your behaviour dictates financial success or failure.

Rich Dad Poor Dad by Robert Kiyosaki

Kiyosaki’s philosophy revolves around assets versus liabilities, where assets make money. In contrast, liabilities cost money, financial education that cannot be taught in schools, and the understanding that wealth is created through investments that generate passive income rather than traditional employment.

The Total Money Makeover by Dave Ramsey

Dave Ramsey teaches people how to get out of debt, save money, and follow a seven-step process to financial freedom through budgeting, saving, and investing in The Total Money Makeover.

I Will Teach You to Be Rich by Ramit Sethi

In I Will Teach You to Be Rich, Ramit Sethi teaches readers how to automate their finances, negotiate salaries and fees, and optimize credit cards and banking. His no-nonsense style allows you to create wealth more easily while enjoying life.

The Simple Path to Wealth by JL Collins

JL Collins covers beneficial basics about stock-market investing and the efficacy of index funds while helping readers acquire the essential mindset necessary to achieve financial independence with a no-fuss, low-risk strategy.

Your Money or Your Life by Vicki Robin

In Your Money or Your Life, the author, Vicki Robin, lays out how deeply connected time and money are and provides readers with mindfulness strategies around spending and actionable tips on how to live with the intent to reach financial independence.

The Millionaire Fastlane by MJ DeMarco

In this ground-breaking book, MJ DeMarco teaches how to create wealth through entrepreneurship, escape the rat race, and build scalable businesses that hit the financial fast lane.

The Little Book of Common Sense Investing by John C. Bogle

In The Little Book of Common Sense Investing, John C. Bogle explains how readers can harness the power of index fund investing, long-term strategies, and knowing what return you will likely get to build steady wealth over time.

The One-Page Financial Plan by Carl Richards

Carl Richards lays out how goal setting and simplifying complex decisions create the one-page financial plan readers need to find financial success in The One-Page Financial Plan.

3. Free Online Courses:

Coursera: The University of Florida’s “Personal & Family Financial Planning” teaches essential skills to manage money for 9 weeks. You will also be taught how to create financial plans and get basic knowledge related to investments and ways to protect your money from risks. The best part is that you can make it fit your schedule by studying at your own pace.

edX: “Finance for Everyone” from the University of Michigan, a six-week course to help you grasp the money decisions you’ll face in the future. You’ll learn why money today is worth more than tomorrow and how risks can pay off. The exercises are interactive, amusing, and help the ideas stick.

Khan Academy: Personal Finance includes taxes and retirement savings, the home-buying process, and investing your money. You go at your own pace through the lessons and check your learning with practice exercises that encourage you to grasp the material.

Udemy: “Personal Finance Basics” — the building blocks of managing your money. You will learn how to make and respect a budget, innovative ways to manage debt, and better ways to save. The free intro courses are delivered via video lessons, translating complex ideas into digestible knowledge.

MIT OpenCourseWare: “Personal Finance Planning” provides college course materials. Although more complex, it brings in higher-level concepts about money and demonstrates how we encounter them daily. You access the same lecture notes and assignments that help college students prepare for sophistication about money at the next level.

4. Financial Podcasts:

ChooseFI dives deep into various aspects of FI with episode-length discussions. The podcast covers ways to lower costs, increase earnings, and maximize available investments to fast-track the journey to financial independence.

Money For the Rest of Us — Investment and economics education that, despite the title, is accessible for everyday investors. The host explains investment vehicles, breaks down complex market concepts , and provides context on economic trends directly related to personal portfolios.

So Money with Farnoosh Torabi — offers candid conversations with financial wiz, business owners, and celebrities. Torabi’s method: The interviews cover everything from the nuts and bolts of managing money day-to-day to career advice and personal finance philosophies from various voices.

Afford Anything by Paula Pant — the philosophy of making “intentional” financial decisions aligned with your values. Pant examines the trade-offs inherent in economic decisions and focuses listeners on aligning spending with priorities instead of using hard-and-fast rules.

The Dave Ramsey Show: “Money” advice on getting out of debt and building wealth. Using his proven financial methodology, Ramsey gives you straightforward, practical tips on getting rid of debt, budgeting strategies, and building wealth based on principles that stand the test of time.

5. Additional Learning Resources:

YouTube channels such as Graham Stephan and The Financial Diet provide visual financial education that’s entertaining and easy to digest.

Financial advisor consultations help you by giving advice that matches your money situation and future goals. They look at your income, savings, and plans to create the best strategy for you.

Education-based money management apps track spending and teach budgeting concepts using interactive features.

On the other hand, finance workshops or seminars are targeted at certain subjects , and specialists provide presentations in a combined setup.

Membership in an investment club promotes learning by discussing and analyzing investments among a group.

Plan Your Financial Goals

Reasonable money goals will help you make better decisions about your money. Once you know where you want to go — you can create a plan to get there. Drawing clear goals also makes it easier for you to save and spend wisely.

These 10 financial goals most of us hope to achieve.

-

- Paying off credit card debt: Unpaid credit cards tend to carry 15–25% interest rates. Since interest makes your purchases significantly more expensive over time, you should prioritize paying off this debt. For instance, a $1,000 balance with a 20% interest translates to an additional $200 bill if left unpaid at the end of the year.

-

- Paying off student loans: Many students graduate with debt from loans. A repayment plan allows you to address this long-term debt. Particular loans have some income-based repayment or forgiveness programs, depending on your line of work, if you become a teacher or do public service work.

-

- Creating an emergency fund: This is money saved for unexpected issues such as car repairs, medical bills, or job loss. The general advice from experts is to accumulate enough savings for 3-6 months of living expenses. Save $500 at first, then gradually increase to a larger amount.

-

- Buying a home: Typically means saving for a down payment (usually 3-20% of the price of the house), having a relatively well-written credit score (ideally more significant than 700), and preparing for the other costs , including property taxes, insurance, and maintenance (which can amount to 1-4% of your home value each year.)

-

- Retirement saving: It’s not too early to understand retirement saving at your age! Money contributed in your teens and twenties has 40+ years to compound. For instance, $1,000 saved at age 15 could grow to more than $15,000 by retirement age without depositing another penny.

-

- Retirement saving: It’s not too early to understand retirement saving at your age! Money contributed in your teens and twenties has 40+ years to compound. For instance, $1,000 saved at age 15 could grow to more than $15,000 by retirement age without depositing another penny.

-

- Saving for a wedding: The average wedding currently costs approximately $30,000, although many pay slightly less. Having a dedicated savings account for this goal will save you from starting married life in debt. If you set aside $100 a month for five years, you’d have $6,000 before interest to spend on a wedding.

-

- Planning for vacation: You can avoid racking up huge credit card debt to take a vacation by regularly saving money in a “vacation fund.” Even putting away $25 a week over an entire year amounts to $1300 that can go toward a fun getaway without worrying about the bills afterwards.

-

- Paying off medical expenses: Even with insurance, healthcare can be costly. Don’t ignore medical bills when they arrive! The good news is that many hospitals provide payment plans with no or low interest or financial assistance programs for those who qualify based on income.

-

- Entrepreneurship: most businesses start small. Having the capital means you have a little flexibility and don’t need to make yourself entirely beholden to loans. Young entrepreneurs, for example, may require $500—$5,000 to launch a lawn care service, online store or other small business.

How to Achieve Your Financial Goals

Step 1: Get Specific

Instead of “I want to save money,” use “I want to save $500 for a new bike by next summer.” Specific numbers and dates help your target be tangible and measurable.

Step 2: Make a Plan

Divide significant goals into smaller steps. If you wanted to save $500 over ten months, you’d need to save $50 a month, or roughly $12.50 a week. Could you do this by doing chores, babysitting, or keeping some of your allowance?

Step 3: Track Your Progress

Keep a notebook, an app, or even something as low-tech as a tally chart on your wall to see your money grow. Tracking your progress will keep you motivated and make saving more enjoyable.

Step 4: Reduce Spending

Look for ways to spend less. Could you take lunch from home rather than purchasing it? Could you occasionally watch movies at home instead of going to the theatre? Small changes add up quickly!

Step 5: Increase Income

Consider how you might increase your earnings. Could you walk dogs, do yard work for neighbours, sell crafts or tutor younger kids? However, in most cases, extra income will help you reach goals faster.

Step 6: Avoid Impulse Buys

Do not make any purchases for 24-48 hours. The big question: “Do I need this? “Will this help me reach my goals? Too often, the thrill of purchasing something new fades fast.

Step 7: Learn About Money

Check out books on money management from your school or public library. Learning things like interest, investing, and budgeting now will assist you for the rest of your life.

Remember: Every financial journey starts with a single step. Even saving a few dollars a

Very Informative